Here's an excerpt from Akerlof's Nobel Lecture,

I discovered that the informational problems that exist in the used car market were potentially present to some degree in all markets. In some markets, asymmetric information is fair- ly easily soluble by repeat sale and by reputation. In other markets, such as insurance markets, credit markets, and the market for labor, asymmetric information between buyers and sellers is not easily soluble and results in serious market breakdowns.The rise of Google, Facebook, Amazon, Zynga, and other information aggregators creates a situation where they have an overwhelming informational advantage over both, the buyer (consumer) and the seller (advertiser). Not only they have access to more data about you and the seller, but also they have infinitely greater capabilities to make sense out of this data.

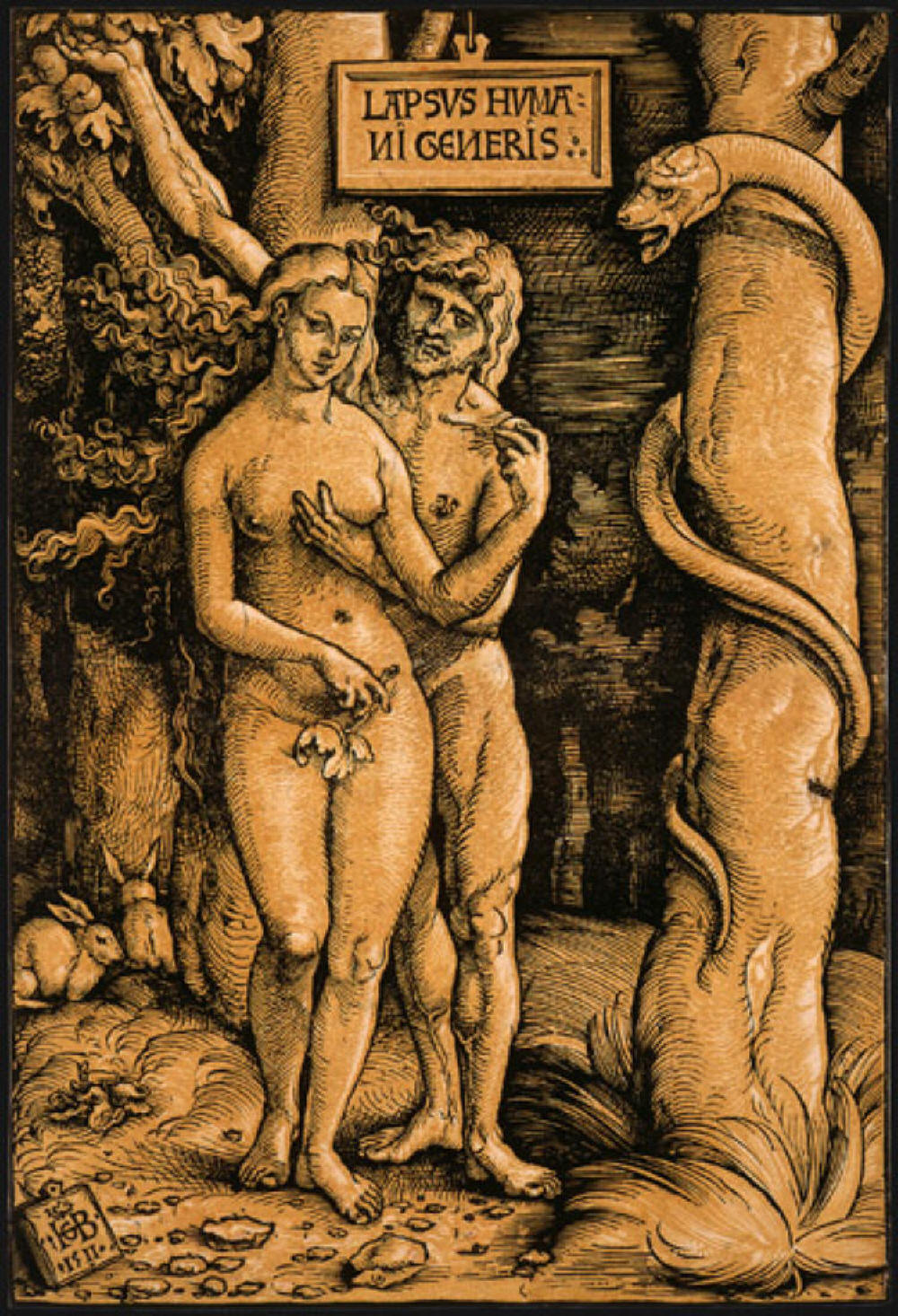

When Google promises not to do evil, they assume god-like powers of knowing the difference between the good and evil. Which begs the question, Are they playing God or the Serpent? In either case we have a three party information asymmetry: Eve (the seller) - Adam (the buyer) - God/Serpent (the knower.) If Akerlof is right, there's a serious market breakdown lurking somewhere inside this setup.

tags: economics, information, control, commerce, science

No comments:

Post a Comment